Roth ira penalty calculator

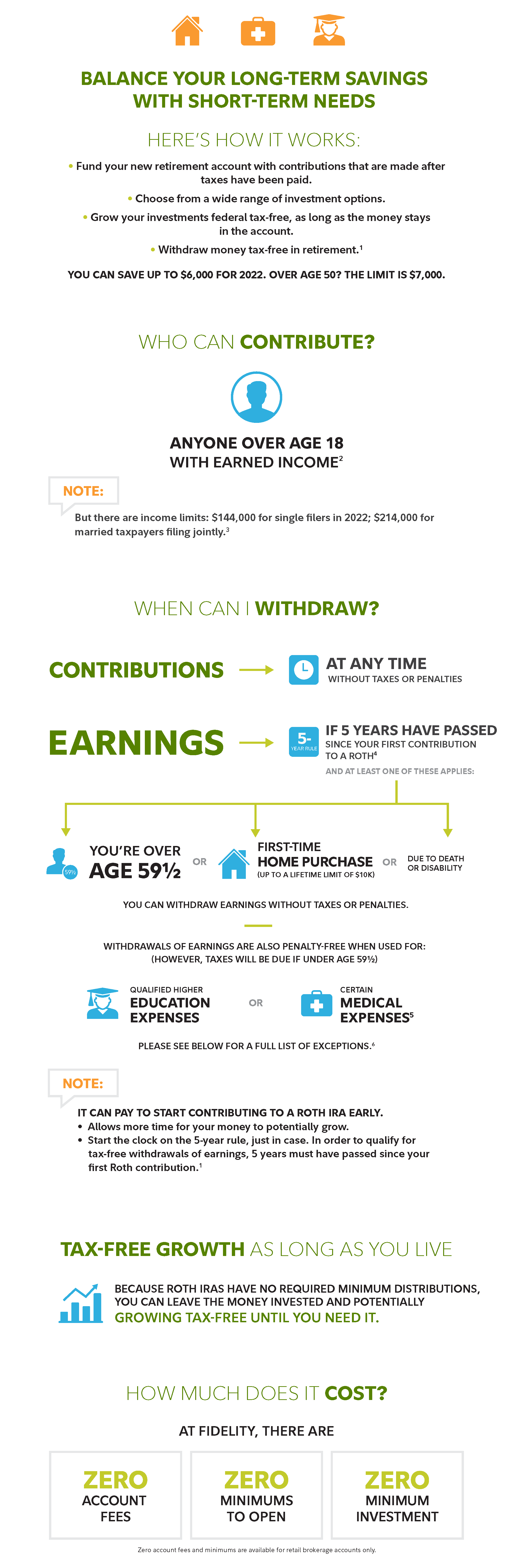

After turning age 59 ½ withdrawals from Roth IRAs are penalty-free. One of the key benefits of a Roth IRA or Roth 401k is that while contributions arent tax-deductible both contributions and earnings can be withdrawn tax and penalty free once you reach age 59½.

Roth Ira Calculator Roth Ira Contribution

Ages younger than 59 ½ with a Roth IRA youve had more than five years you can avoid the penalty for early withdrawal and taxes on earnings if you.

. Withdrawals must be taken after age 59½. Like a traditional 401kand unlike a Roth IRAyou do have to take a required minimum distribution RMD from a Roth 401k unless youre still working for that employer. There are many factors to consider including the amount to convert current tax rate and your age.

You must designate the account as a Roth IRA when you start the account. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after. 1 A distribution from a Roth IRA is tax-free and penalty-free provided that the 5-year aging requirement has been satisfied and at least one of the following conditions.

However there are some exceptions. Withdrawals can be taken out tax-free and penalty-free providing youre 59½ or older and you have met the minimum account holding period currently five years. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you.

With a Traditional IRA you contribute pre- or after-tax dollars your money grows tax-deferred and. If you pay an IRS or state penalty or interest. It is also sometimes called a backdoor IRA.

However contributions to a Roth IRA arent tax deductible. To be considered a qualified distribution the 5-year aging requirement has to be satisfied and you must be age 59 ½ or older or meet one of several exemptions disability qualified first. You may also have to.

In certain hardship situations the IRS lets you take withdrawals before age 59 12 without a penalty. A distribution from a Roth IRA is tax-free and penalty-free provided that the 5-year aging requirement has been satisfied and at least one of the following conditions is met. Converting your Traditional IRA to a Roth IRA may be beneficial to you in the long term.

Once the Custodial IRA is open all assets are managed by the custodian until the child reaches age 18 or 21 in some states. A qualified distribution from a Roth IRA is tax-free and penalty-free. Estimate your tax refund and where you stand Get started.

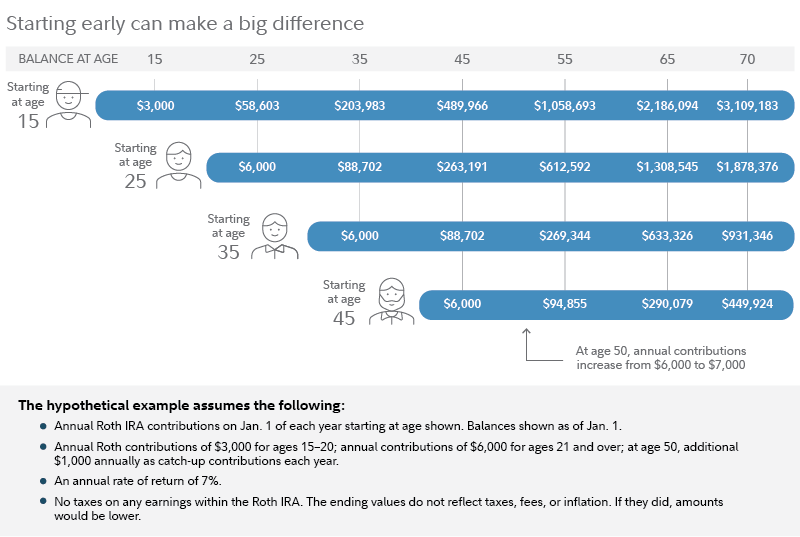

A Roth IRA conversion shifts money from a traditional IRA or a qualified employer sponsored retirement plan such as a 401k or 403b into a Roth IRA. 2021 contribution limits capped at 6000 if under age 50. If youre under age 59½ and you have one Roth IRA that holds proceeds from multiple conversions youre required to keep track of the 5-year holding period for each conversion separately.

The money in your Roth IRAs consists of two kinds. How to Withdraw From a Roth IRA Early Penalty-Free. Rolled over a Roth 401k or Roth 403b to the Roth IRA.

7000 if 50 or older. For more detailed information and to do calculations involving Roth IRAs please visit the Roth IRA Calculator. First contributed directly to the Roth IRA.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. Withdrawals must be taken after a five-year holding period. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income.

Contributions are made using pre-tax money. 158 Click Play to Learn About Required Minimum Distribution RMD. Open a Schwab Roth IRA.

Withdraw up to a 10000 lifetime cap for a. Contributions are made using after-tax money. Converted a traditional IRA to the Roth IRA.

Contributions are the money you deposit into the account up to 6000 a year for 2022 or 7000 if youre age 50. Use our Roth IRA conversion calculator Were here to help Call 866-855-5635 Chat Professional Answers 247 Visit. With a Roth IRA you contribute after-tax dollars your money grows tax-free and you can generally make tax- and penalty-free withdrawals after age 59½.

You may be subject to a 10 federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. Contributions are made using after-tax money. Likewise you must pay income taxes on early withdrawals of earnings from a Roth IRA and you might owe a 10 IRS penalty as well.

Roth IRA contributions are still a long-term investment in a retirement savings plan. Without distribution Roth IRAs can grow tax-free throughout the owners entire lifetime. You reach age 59½ suffer a disability make.

This limit applies across all IRAs. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Direct contributions can be withdrawn tax-free and penalty-free anytime.

Roth IRA withdrawal rules allow you to take out up to 10000 earnings tax and penalty free as long as you use them for a first-time home purchase and you first contributed to a Roth account at. When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ the previous age was 70½.

While Roth IRAs are not intended to be a savings account Roth IRAs do allow you to withdraw funds without the 10 early withdrawal penalty. A Roth IRAs beneficiaries generally will need to take RMDs to avoid penalties although there is an exception for spouses. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Contributions are made using pre-tax money. Roth IRAs are subject to the same rules as traditional IRAs.

However Roth IRA withdrawals are not mandatory during the owners lifetime. Note that 401ks may have additional rules around withdrawals.

Pinterest

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

3jyzvuocctnujm

Pin On Latest Worlwide

What Is The Size Of The Average Retirement Nest Egg Retirement Strategies Retirement Planning Retirement Income

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Pin On Financial Independence App

Traditional Roth Iras Withdrawal Rules Penalties H R Block

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Traditional Vs Roth Ira Calculator

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Save For The Future With A Roth Ira Fidelity

Irs Fresh Start Program How Does It Work Infographic Irs Fresh Start Program Work Infographic

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution